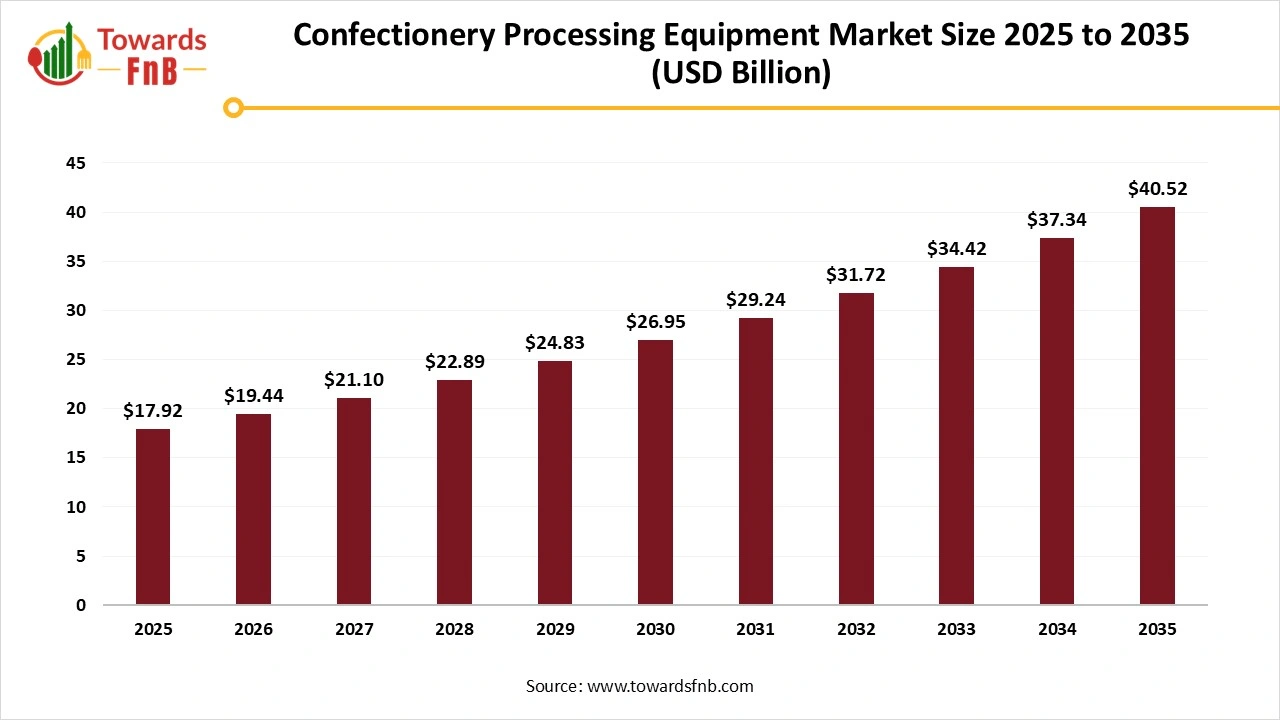

Confectionery Processing Equipment Market Size to Worth USD 40.52 Billion by 2035, Driven by Automation, Premiumization, and AI-Enabled Manufacturing

According to Towards FnB, the global confectionery processing equipment market size is evaluated at USD 19.44 billion in 2026 and is forecast to reach USD 40.52 billion by 2035, reflecting a robust CAGR of 8.5% from 2026 to 2035. This growth reflects sustained capital investment in modern confectionery manufacturing infrastructure across both developed and emerging markets.

Ottawa, Jan. 12, 2026 (GLOBE NEWSWIRE) -- The global confectionery processing equipment market size stood at USD 17.92 billion in 2025 and is predicted to grow from USD 19.44 billion in 2026 to reach around USD 40.52 billion by 2035. A report published by Towards FnB, a sister firm of Precedence Research, highlights that equipment replacement cycles and capacity expansion initiatives are accelerating, particularly among mid- to large-scale confectionery producers.

Market expansion is being driven by the rapid growth of e-commerce and organized retail channels, alongside technological innovation and rising automation levels in food processing facilities. In parallel, stricter hygiene, traceability, and food safety requirements are prompting manufacturers to invest in compliant, digitally enabled equipment that improves operational reliability and product consistency.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5972

Key Highlights of Confectionery Processing Equipment Market

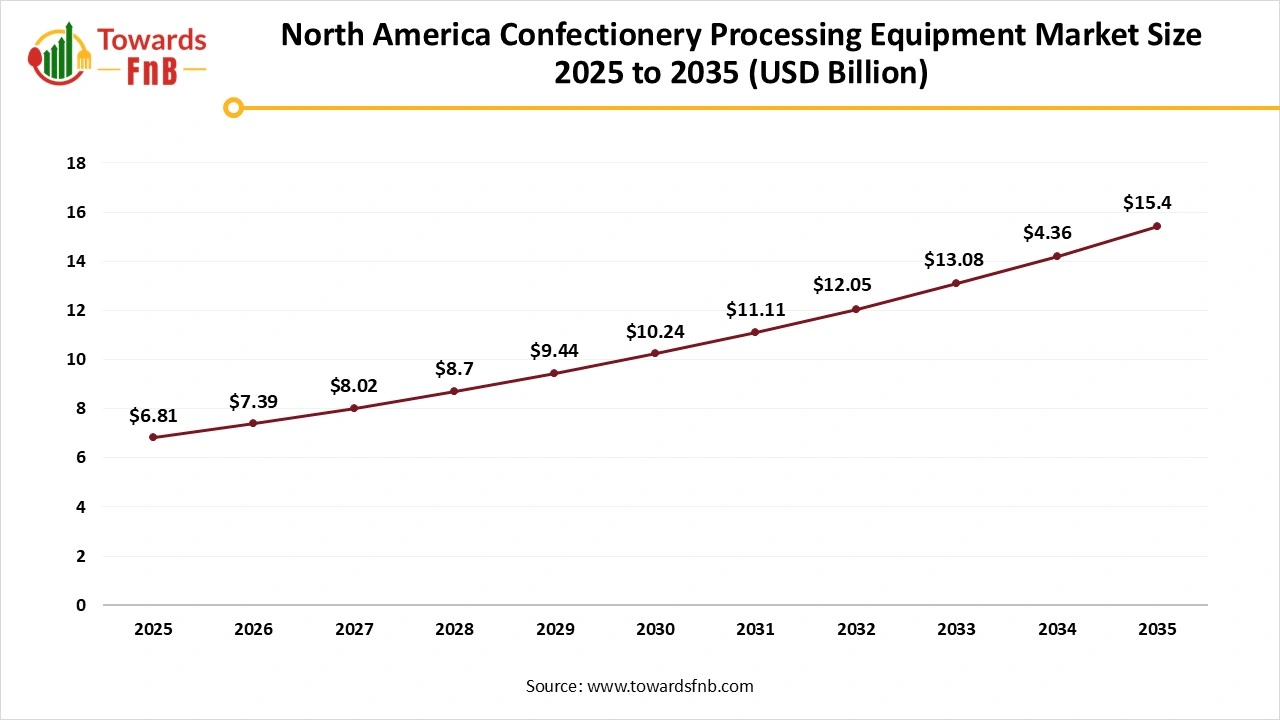

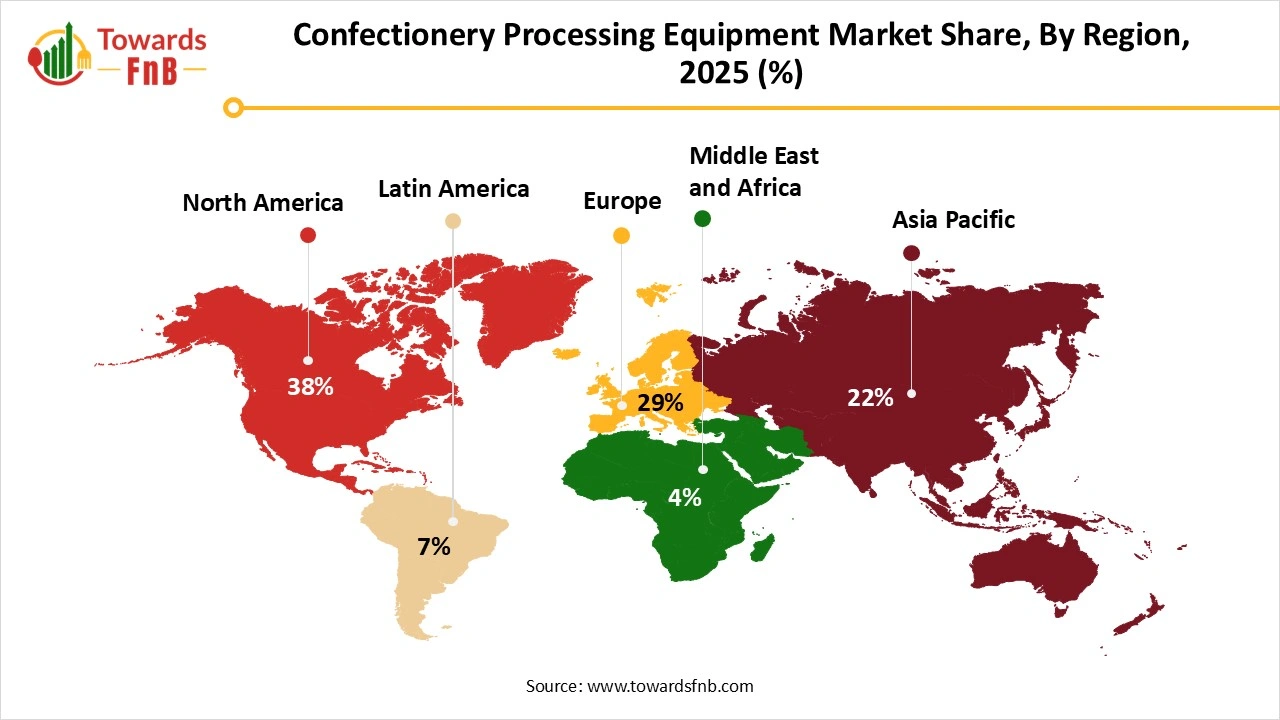

- By region, North America led the confectionery processing equipment market with highest share of 38% in 2025, whereas the Asia Pacific is expected to grow in the forecast period.

- By type, the mixing and blending equipment segment led the confectionery processing equipment market in 2025, whereas the packaging and wrapping equipment segment is expected to grow in the foreseen period.

- By candy type, the chocolate confectionery segment led the market in 2025, whereas the gum confectionery segment is expected to grow in the forecast period.

- By automation level, the automatic segment led the confectionery processing equipment market in 2025, whereas the semi-automatic segment is expected to grow in the foreseeable period.

- By capacity, the medium-scale segment led the confectionery processing equipment market in 2025, whereas the large-scale segment is expected to grow in the forecast period.

- By application, the industrial segment led the confectionery processing equipment market in 2025, whereas the artisanal segment is expected to be the fastest growing in the foreseen period.

“Confectionery manufacturers are entering a new capex cycle driven by automation, product differentiation, and regulatory compliance. Processing equipment is no longer just a production asset it is a strategic enabler for quality consistency, cost efficiency, and brand positioning,” said a Vidyesh Swar, Principal Consultant at Towards FnB.

Technology Aiding the Growth of Confectionery Processing Equipment Industry

The confectionery processing equipment market is expected to grow due to higher demand for organic and premium sweet treat options, along with technological advancements in the industry. The industry involves the use of mixers, cookers, molding systems, and automated lines for the manufacturing of a diverse portfolio of confections such as chocolates, gummies, and hard candies. Technologically advanced features of machinery help to elevate the product quality and also help to lower human error and waste, further fueling the growth of the confectionery processing equipment market. Such machines also help to aid huge volume manufacturing with fewer errors and make it more cost-effective.

Impact of AI in the Confectionery Processing Equipment Market

Artificial intelligence is being integrated into confectionery processing equipment to enhance process precision, throughput efficiency, and quality consistency across chocolate, sugar confectionery, and gum manufacturing lines. Machine learning algorithms are used to analyze data from tempering, cooking, cooling, and molding systems to optimize parameters such as temperature gradients, viscosity profiles, crystallization kinetics, and residence time, which are critical for achieving stable cocoa butter polymorphism, uniform texture, and controlled snap. In automated production environments, AI-enabled vision systems inspect products in real time to detect surface defects, bloom formation, weight deviations, and filling inconsistencies, enabling immediate corrective actions without interrupting line speed.

AI-driven predictive maintenance models are increasingly embedded in equipment control systems to monitor motor load, vibration, and thermal signals, reducing unplanned downtime and extending the service life of high-value assets such as tempering units, depositors, and enrobers. From an operational and compliance perspective, AI supports digital traceability and process validation by linking batch data, cleaning-in-place cycles, and allergen changeovers to quality records, aligning with food safety and equipment hygiene expectations referenced by the Food and Agriculture Organization and regulatory oversight applied by bodies such as the European Food Safety Authority. Overall, AI acts as a control and reliability layer in the confectionery processing equipment market, enabling manufacturers to maintain consistent product quality, reduce waste, and operate complex, high-speed lines with greater predictability and cost efficiency.

New Trends of Confectionery Processing Equipment Market

- Higher demand for healthier and innovative versions of sweets, candies, and gummies is one of the major factors for the growth of the market.

- Technological advancements helpful to manage raw material and wastage and enhance product quality also help to fuel the growth of the market.

- Use of technological features by startups, such as AI, data analytics, and ML, to improve product efficiency, lower waste, and enhance efficiency.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/confectionery-processing-equipment-market

Recent Developments in Confectionery Processing Equipment Market

- In June 2025, Gluten-free specialist and renowned name Juvela opened a £ 1.5 million allergen-free bakery in South Wales. The bakery is fitted with state-of-the-art equipment and is located in Pontypool.

Product Survey of the Confectionery Processing Equipment Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Mixing and Kneading Equipment | Blends ingredients uniformly and develops mass consistency for confectionery formulations | Batch mixers, continuous mixers, sigma mixers | Chocolate manufacturers, sugar confectionery producers | Industrial confectionery mixers |

| Cooking and Boiling Systems | Heat and concentrate sugar and syrup mixtures to precise temperatures and solids content | Vacuum cookers, batch cookers, continuous boiling systems | Hard candy, toffee, caramel manufacturers | Continuous candy cooking systems |

| Chocolate Refining and Conching Equipment | Reduces particle size and develops flavor and texture in chocolate | Ball mills, five-roll refiners, longitudinal conches | Chocolate and compound manufacturers | Chocolate refining and conching lines |

| Tempering Machines | Controls crystallization of cocoa butter for gloss, snap, and stability | Batch temperers, continuous tempering machines | Chocolate manufacturers, artisanal chocolatiers | Automatic chocolate tempering machines |

| Depositing Machines | Precisely deposits liquid or semi-liquid confectionery masses into molds | Servo-controlled depositors, multi-shot depositors | Gummies, chocolates, fondants, jellies | Confectionery depositing systems |

| Molding and Starch Mogul Systems | Shapes confectionery products using molds or starch trays | Starch moguls, silicone mold systems | Gummy and jelly candy producers | Starch mogul production lines |

| Cooling and Cooling Tunnels | Rapidly cools products to set structure and maintain shape | Linear cooling tunnels, spiral cooling systems | Chocolate bars, molded candies | Confectionery cooling tunnel systems |

| Enrobing Equipment | Applies chocolate or compound coatings evenly to centers | Bottom, top, and full enrobers | Chocolate-coated confectionery producers | Chocolate enrobing machines |

| Cutting and Forming Machines | Shapes confectionery masses into uniform pieces | Rope sizers, guillotines, rotary cutters | Toffees, chews, hard candies | Candy forming and cutting equipment |

| Packaging Equipment | Wraps, seals, and packs finished confectionery products | Flow wrappers, twist wrappers, cartoning machines | All confectionery manufacturers | Confectionery packaging lines |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5972

Confectionery Processing Equipment Market Dynamics

What are the Growth Drivers of the Confectionery Processing Equipment Market?

Higher demand for premium, organic, plant-based, and artisanal options by consumers is one of the major factors for the growth of the market. Use of advanced technology for manufacturing of premium and artisanal treats, along with customizable options without any major changes, is another vital factor for the growth of the market. Higher demand for vegan and plant-based options due to growing health and wellness trends also helps to fuel the growth of the market.

High Machinery Costs are hampering the Market’s Growth

High costs of fully automated machines and technologically advanced features are one of the major factors for the growth of the market. The setup and maintenance of advanced machinery require higher costs compared to manual machinery. Hence, small and medium-sized businesses are unable to afford them, further restricting the growth of the confectionery processing equipment market.

Emerging Health and Wellness Trends Aiding the Growth of the Market

A growing health-conscious population leading to higher demand for organic, premium, artisanal, and functional options is one of the major opportunities for the growth of the market. Hence, confectionery processing manufacturers ensure to make sweet treats in low-sugar, no-sugar, or low-calorie options, which are highly demanded by consumers. Hence, such factors create major opportunities for the growth of the confectionery processing equipment market in the foreseeable period.

Confectionery Processing Equipment Market Regional Analysis

North America led the Confectionery Processing Equipment Market in 2025

North America dominated the confectionery processing equipment market in 2025, due to higher demand for artisanal, premium, and organic options of sweet treats in the region by consumers. Adoption of technologically advanced machinery and their features, such as AI, ML, robotics, and energy-efficient systems, also helps to fuel the market’s growth due to easy production in high volumes in the region. The US has a major role in the growth of the market due to higher usage of technologically advanced methods, which are helpful for enhanced quality of the product and lower human error.

Europe is observed to be the fastest-growing region in the Foreseen Period

Europe is observed to be the fastest-growing region in the foreseen period due to higher demand for technologically advanced confectionery processing equipment, which is helpful for the growth of the market. Use of technological features such as AI, ML, IoT, robotics, controlled systems, and various similar features helps to enhance the quality of the product, further fueling the market’s growth. Higher usage of energy-efficient machinery to maintain sustainability also helps to propel the growth of the confectionery processing equipment market in the foreseeable period. Germany has made a major contribution to the growth of the market due to higher usage of technologically advanced machinery for the manufacturing of premium, organic, vegan, and plant-based options, which are highly demanded by consumers in the region.

Asia Pacific is observed to have a Notable Growth in the foreseeable period

Asia Pacific is observed to have notable growth in the foreseen period due to factors such as rapid urbanization, a growing middle-class population, and growing disposable income. Higher usage of technologically advanced machinery for the manufacturing of premium and artisanal treats also helps to fuel the growth of the market. India and China have made a major contribution to the growth of the market due to the growing population of health-conscious consumers in the region, leading to higher demand for low-calorie, low-sugar, and healthier options, fueling the growth of the confectionery processing equipment market.

Trade Analysis for the Confectionery Processing Equipment Market

What Is Actually Traded (Product Forms and HS Proxies)

- Confectionery manufacturing machinery, including mixers, cookers, depositors, moulders, and cooling tunnels for chocolate, sugar confectionery, and gum, is commonly declared under HS 8438 (machinery for the industrial preparation of food or drink).

- Chocolate-specific processing equipment, such as refiners, conches, tempering machines, and enrobers, is typically classified under HS 8438, with sub-classification depending on function and integration level.

- Candy forming and shaping machines, including rope sizers, batch rollers, extruders, and cutters, are generally cleared under HS 8438.

- Packaging-integrated confectionery lines, where forming and wrapping modules are supplied together, may include components classified under HS 8422 (packing or wrapping machinery).

- Spare parts, moulds, dies, and processing modules are traded separately under corresponding machinery parts headings linked to HS 8438 and HS 8422.

Top Exporters (Supply Hubs)

- Germany: Leading exporter of high-precision confectionery processing equipment, supported by strong mechanical engineering, automation expertise, and compliance with global food safety standards.

- Italy: Major exporter of chocolate and confectionery machinery, driven by specialized equipment clusters serving artisanal and industrial confectionery producers.

- China: Large-volume exporter of cost-competitive confectionery machinery for small and mid-scale producers, supported by extensive manufacturing capacity.

- Netherlands: Exporter of advanced chocolate processing and forming systems linked to its strong cocoa and confectionery processing ecosystem.

Top Importers (Demand Centres)

- United States: Significant importer of confectionery processing equipment driven by large-scale chocolate manufacturing, product innovation cycles, and replacement demand.

- European Union: Strong intra-EU and extra-EU imports reflecting modernization of confectionery plants and expansion of premium chocolate production.

- India: Growing importer of confectionery machinery due to expansion of domestic chocolate and sugar confectionery manufacturing capacity.

- Southeast Asia: Rising imports linked to growth in packaged confectionery consumption and localization of multinational confectionery production.

Typical Trade Flows and Logistics Patterns

- Complete confectionery processing lines are shipped via containerized sea freight or break-bulk transport due to size and weight.

- Large systems are often delivered in multiple consignments and assembled on-site by supplier technicians.

- High-precision components and spare parts are frequently shipped by air to minimize production downtime.

- Regional service hubs support installation, commissioning, maintenance, and operator training.

Trade Drivers and Structural Factors

- Global confectionery consumption supports sustained investment in processing equipment.

- Product differentiation through new textures, fillings, and shapes drives adoption of advanced forming and depositing systems.

- Automation and consistency requirements favor equipment that improves yield control and reduces manual handling.

- Food safety and hygienic design standards influence purchasing and replacement decisions.

- Capacity expansion in emerging markets reduces reliance on imported finished confectionery.

Regulatory, Quality, and Market-Access Considerations

- Confectionery equipment must comply with machinery safety, electrical standards, and food contact material regulations.

- Hygienic design and cleanability requirements affect acceptance in regulated markets.

- Certification, conformity assessment, and technical documentation are required prior to import and installation.

- Local installation approvals and operator certification can influence commissioning timelines.

Government Initiatives and Public-Policy Influences

- Industrial modernization and food processing incentives indirectly stimulate investment in confectionery equipment.

- Food safety regulations drive replacement of legacy machinery with compliant systems.

- Trade facilitation measures and capital equipment tariff policies affect cross-border machinery flows.

Confectionery Processing Equipment Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 8.5% |

| Market Size in 2026 | USD 19.44 Billion |

| Market Size in 2027 | USD 21.10 Billion |

| Market Size in 2030 | USD 26.95 Billion |

| Market Size by 2035 | USD 40.52 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Europe |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Confectionery Processing Equipment Market Segmental Analysis

Type Analysis

The mixing and blending segment led the confectionery processing equipment market in 2025, due to the high importance of the segment in the growth of the market. The segment focuses on mixing and blending of the candies and sweet mixture for proper taste, texture, and consistency. Use of advanced technologies in the form of high-shear mixers and automated systems also helps to fuel the market’s growth. Technological advancements also help to manage the versatility of the product without major changes, and seamless activities also help to propel the market’s growth.

The packaging and wrapping equipment segment is expected to grow in the foreseen period due to higher demand for options such as single-serve, portable, and convenient to store. Hence, the segment has a major contribution to the growth of the market. The market also observes growth due to growing sustainability awareness, leading to higher demand for eco-friendly and reusable packaging, which helps lower the carbon footprint of the packaging industry.

Candy Type Analysis

The chocolate confectionery segment dominated the confectionery processing equipment market in 2025, due to the higher demand for different types of chocolates for different occasions, which is a major factor for the growth of the market. Higher demand for different types of chocolate options, leading to higher demand for technologically advanced machinery for the manufacturing of versatile and premium options, also helps to fuel the market’s growth. Higher demand for plant-based and organic chocolates also helps to enhance the market’s growth.

The gum confectionery segment is expected to grow in the foreseen period as it is highly demanded by health-conscious consumers due to its multiple benefits, as they are enriched with vitamins and minerals. Higher demand for organic and plant-based options also helps to fuel the growth of the market. Manufacturing of such options requires the use of advanced machinery for enhanced product quality, further fueling the growth of the market. They also help to manage sustainability and lower waste, further enhancing the growth of the confectionery processing equipment market in the foreseeable period.

Automation Level Analysis

The automatic segment led the confectionery processing equipment market in 2025, due to the use of technological advancements in the form of AI, ML, data analytics, controlled systems, and IoT. Such features help manufacturers in high-volume manufacturing seamlessly and with fewer errors. Such features are also useful for the manufacturing of healthier, organic, functional, and premium options, further fueling the growth of the market.

The semi-automatic segment is expected to grow in the foreseen period due to its cost-effectiveness, allowing small and medium enterprises to grow their business. The segment allows developing countries to make adjustments to their product and cost-effectively manufacture premium and functional options, helpful for the growth of the market in the foreseeable period.

Capacity Analysis

The medium-scale segment led the confectionery processing equipment market in 2025, due to the popularity of making different types of chocolates, sweets, and snacks, fueling the growth of the market. The medium-scale segment manufactures different types of snacks and sweets at cost-effective methods with the help of cost-effective machines. Hence, the segment has a major contribution to the growth of the market.

The large-scale segment is observed to grow in the foreseen period due to its higher usage of technological features, fueling the growth of the market. Features such as AI and robotics help large-scale manufacturers in seamless high-production volume, further fueling the growth of the market. Higher demand for plant-based and premium options involving complex machinery, with the help of technological assistance, smoothens the whole process, which is helpful for the growth of the market.

Application Analysis

The industrial segment led the confectionery processing equipment market in 2025, due to a major shift towards the adoption of Industry 4.0, with robotics and AI helping to fuel the growth of the market. This technological surge helps in the efficient manufacturing of premium and organic snacks with convenient packaging, further fueling the growth of the market. The segment also focuses on seamless manufacturing of vegan and plant-based treats, which is further helpful for the growth of the market.

The artisanal segment is expected to be the fastest-growing in the foreseen period due to higher demand for premium, organic, fortified, and sophisticated options by consumers lately. It has led to higher demand for complex machinery involved in the manufacturing of such treat options. Such machinery is also useful for the manufacturing of vegan and plant-based treats, further fueling the growth of the market. Complex machinery also helps in the manufacturing of artisanal treats, along with customized options without any major changes, fueling the growth of the market in the foreseen period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Dietary Supplements Market: The global dietary supplements market size is projected to reach USD 507.33 billion by 2035, growing from USD 229.77 billion in 2026, at a CAGR of 9.2% from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Market Leaders and Technology Contributors in Confectionery Processing Equipment

- Alfa Laval – Provides hygienic heat transfer, separation, and fluid-handling solutions widely used in confectionery processing. Its equipment supports food safety compliance, energy efficiency, and sustainability goals, making it a key contributor to large-scale plant modernization and equipment replacement programs.

- Robert Bosch GmbH (Syntegon) – Supplies integrated processing and packaging systems with advanced automation and digital control technologies. The company plays a central role in enabling high-speed, low-defect production environments for multinational confectionery manufacturers adopting Industry 4.0 practices.

- JBT Marel – Delivers automated food processing solutions following the JBT–Marel integration, expanding its footprint across confectionery and adjacent food sectors. Its systems help manufacturers improve throughput, consistency, and labor efficiency in large-scale production settings.

- GEA Group Aktiengesellschaft – Offers engineered processing systems such as mixers, thermal units, and hygienic solutions tailored for confectionery applications. The company is widely involved in global capacity expansion and plant upgrade projects where long-term reliability and process stability are critical.

- Tanis Confectionery – Specializes in modular and flexible equipment for gummies, jellies, and functional confectionery products. Its solutions support rapid product innovation and are widely adopted in vitamin-enriched, nutraceutical, and functional candy manufacturing.

- Candy Worx – Focuses on customized and adaptable confectionery equipment for small and mid-sized producers. The company enables cost-effective automation adoption, supporting emerging brands and regional manufacturers transitioning from manual to semi-automated production.

- Caotech Grinding Technology – Develops specialized grinding and refining equipment for cocoa and chocolate processing. Its technologies play a crucial role in achieving consistent particle size, texture, and flavor development in both industrial and premium chocolate production.

- Royal Duyvis Wiener B.V. – Provides comprehensive cocoa and chocolate processing systems covering the entire value chain from bean to finished product. The company is closely associated with high-quality chocolate manufacturing and vertically integrated processing operations.

- SELMI GROUP – Manufactures compact and automated chocolate processing machines designed for artisanal and premium producers. Its equipment supports small-batch production while maintaining professional quality standards, aligning with the growth of craft and specialty chocolate brands.

- Baker Perkins – Supplies continuous processing equipment for candy, gum, and baked confectionery products. The company is recognized for enabling efficient, high-volume production with consistent output in chewing gum and hard candy manufacturing.

-

Loynds – Designs equipment for toffee, fudge, caramel, and deposit-based confectionery products. Its machinery supports both artisanal craftsmanship and scalable production, making it suitable for specialty producers and regional confectionery brands.

Segments Covered in the Report

By Type

- Mixing and Blending Equipment

- Molding and Shaping Equipment

- Coating and Enrobing Equipment

- Extrusion and Forming Equipment

- Cutting and Dividing Equipment

- Packaging and Wrapping Equipment

By Candy Type

- Chocolate Confectionery

- Sugar Confectionery

- Gum Confectionery

- Gelatin Confectionery

- Other Confectionery

By Automation Level

- Manual

- Semi-automatic

- Automatic

By Capacity

- Small-scale

- Medium-scale

- Large-scale

By Application

- Industrial

- Commercial

- Artisanal

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5972

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.